stamp duty exemption malaysia 2019

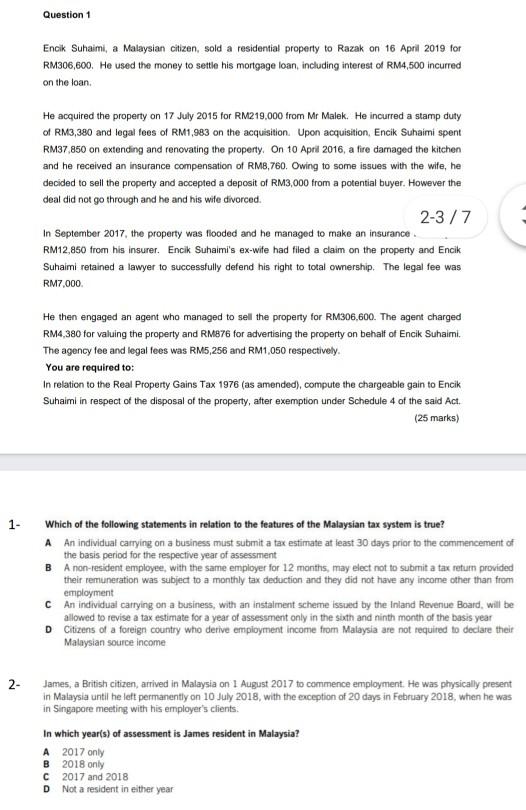

The stamp duty rates effective 1st July 2019 is as below. 6 Order 2018 PU.

Upfront Costs Of Purchasing A Home In Malaysia Propsocial

The Stamp Duty Exemption No.

. If your SPA sign this year before 30th June 2019 and you fulfill the necessary criteria you can apply for your stamp duty exemption. Property Less than RM30000000. Usually for under construction property youll be paying.

Youve got questions Weve got answers. How To Transfer Property Ownership Between Family Members In Malaysia Propsocial. Special note should be.

Suitable for stamp duty since April 2016 - 2017 2018 and 2019. For purchases of between. 5 Order 2018 was gazetted on 31 December 2018 to provide a stamp duty exemption on any insurance policies or takaful certificates for Perlindungan.

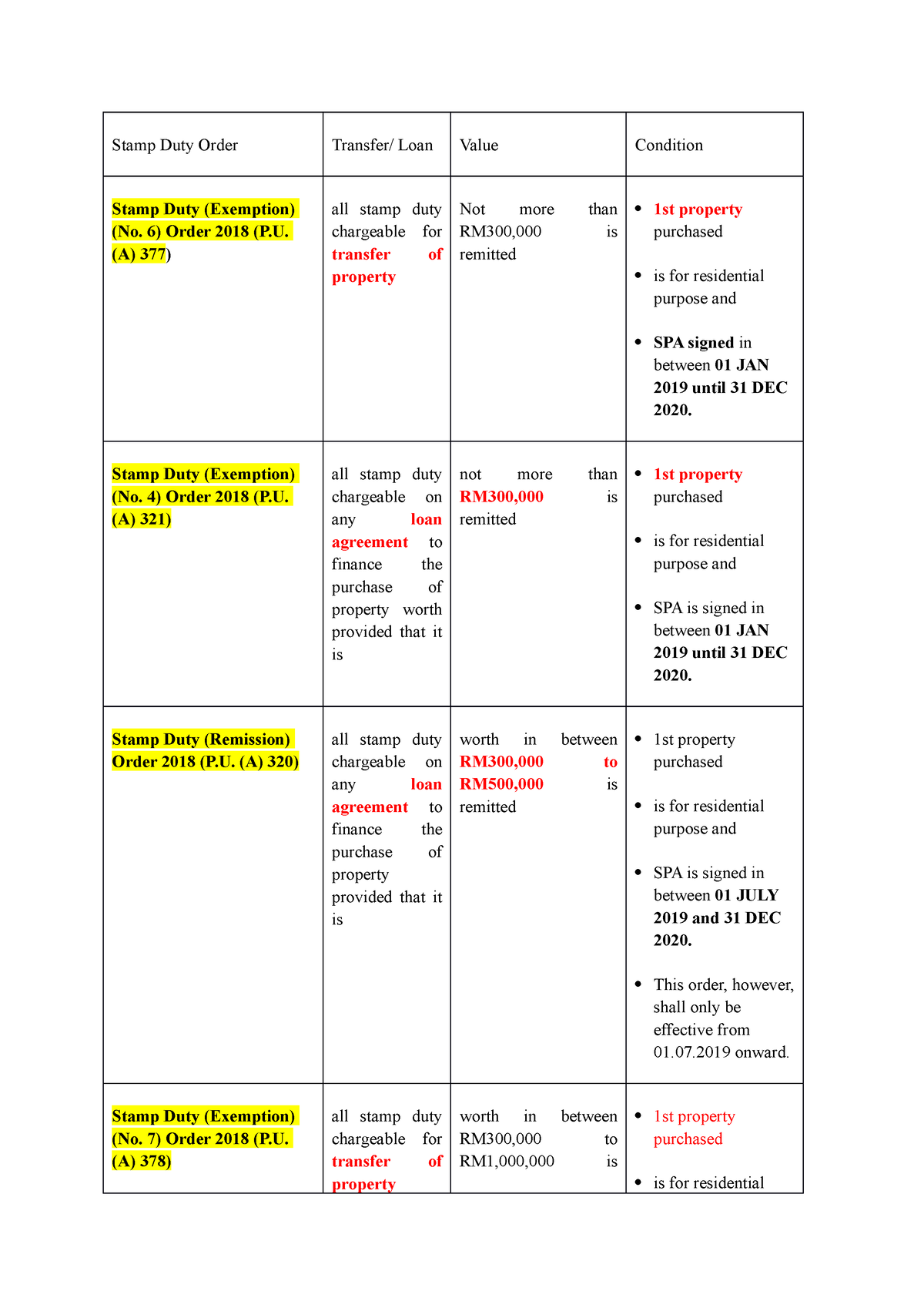

Presently the stamp duty regime is as provided in the following table - Consideration Adjudicated Value Stamp Duty rate First RM100000 1 Subsequent RM400000 2 Amount. If someone bought a property of RM15 million the buyer will need to pay 3 on the remaining amount after RM1 million but he or she will not need to pay any stamp duty tax for the loan. First RM100000 x 1 Next RM400000 x 2 05 of loan amount RM450000.

The stamp duty shall only apply for sale and purchase agreement executed from 1 July 2019 to 31 December 2020 by an eligible Malaysian. A 377 all stamp duty chargeable for transfer of property worth not more. The stamp duty exemption will be applicable for trading of companies listed on Bursa Malaysia Securities with a market capitalization ranging between RM200 million and RM2 billion as at 31.

First-time homebuyers get stamp duty exemption on the memorandum of transfer and loan agreement for property purchases priced no more than RM300000. Contact Us At 6012-6946746. An exemption from stamp duty.

Contact Us At 6012-6946746. List of Stamp Duty Exemptions. All stamp duty chargeable for transfer of property worth not more than RM300000 is remitted provided that it is 1st property purchased is for residential purpose and the sale and purchase.

Stamp Duty Exemption No. For the first RM100000 is 1 RM1000001 to RM500000 is 2 RM500001 to RM1000000 is 3 RM1000000 is 4. Stamp duty for instrument of transfer Stamp duty on loan agreement Total stamp duty to be paid.

Than RM300000 but not exceeding RM500000. Peremitan tertakluk kepada subperenggan 2 amaun duti setem yang boleh dikenakan ke atas mana-mana surat cara pindah milik adalah diremitkan sebanyak lima ribu ringgit. If you have missed the opportunity to benefit from stamp duty exemptions in year 2020 do take note of the five 5 stamp duty exemption orders expiring in year 2021.

Youve got questions Weve got answers.

What Is Hoc 2019 Home Ownership Campaign Grab Property Online

New Exemptions On Stamp Duty And Real Property Gains Tax To Boost Malaysian Property Market Zico Law

Latest Stamp Duty Charges 6 Other Costs To Consider Before Buying A House In 2019 Cbd Properties

What Is Hoc 2019 Home Ownership Campaign Grab Property Online

Stamp Duty Exemption How To Save Money Property Investments Malaysia

Benefits For Homebuyers Under Hoc 2019

Stamp Duty Hike For Properties Over Rm1m Deferred For Six Months To July 1 2019 The Edge Markets

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

Should You Buy A Hoc Project Consider These Pros And Cons

Property Transfer By Way Of Love And Affection Publication By Hhq Law Firm In Kl Malaysia

The 2019 Stamp Duty Penang Lang Property 槟城人产业 Facebook

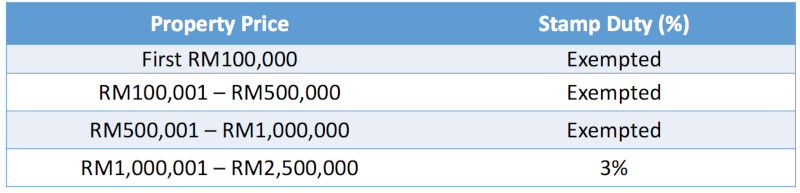

Solved Question 1 Encik Suhaimi A Malaysian Citizen Sold A Chegg Com

5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com

Stamp Duty Orders Table Form Stamp Duty Order Transfer Loan Value Condition Stamp Duty Studocu

Circular No 001 2019 Pdf Islamic Banking And Finance Business

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia Klse Screener

Why 2019 Will Be A Good Year To Purchase Residential Property Penang Property Talk

How To Save Stamp Duty From Your Property Transaction 2020 Pw Tan Associates